Intelligent Payments

Reimagining how money moves

Ecosystem Building

Turning Fragments into Digital Clarity

Experience Design

Where Ideas Learn to Feel

AI Enablement

From Algorithms to Advantage

Web3 Solutions

Simplifying the Digital Frontier

Loyalty & Engagement

Making Every Interaction Count

Process Evolution

Where Process Meets Digital Progress

Where cash finds its future

Solutions that make payments effortless and secure. Built to connect people, platforms, and everyday transactions with ease.

PayNest Review

Coming soon

Developer Handbook

Coming soon

Project Blueprint

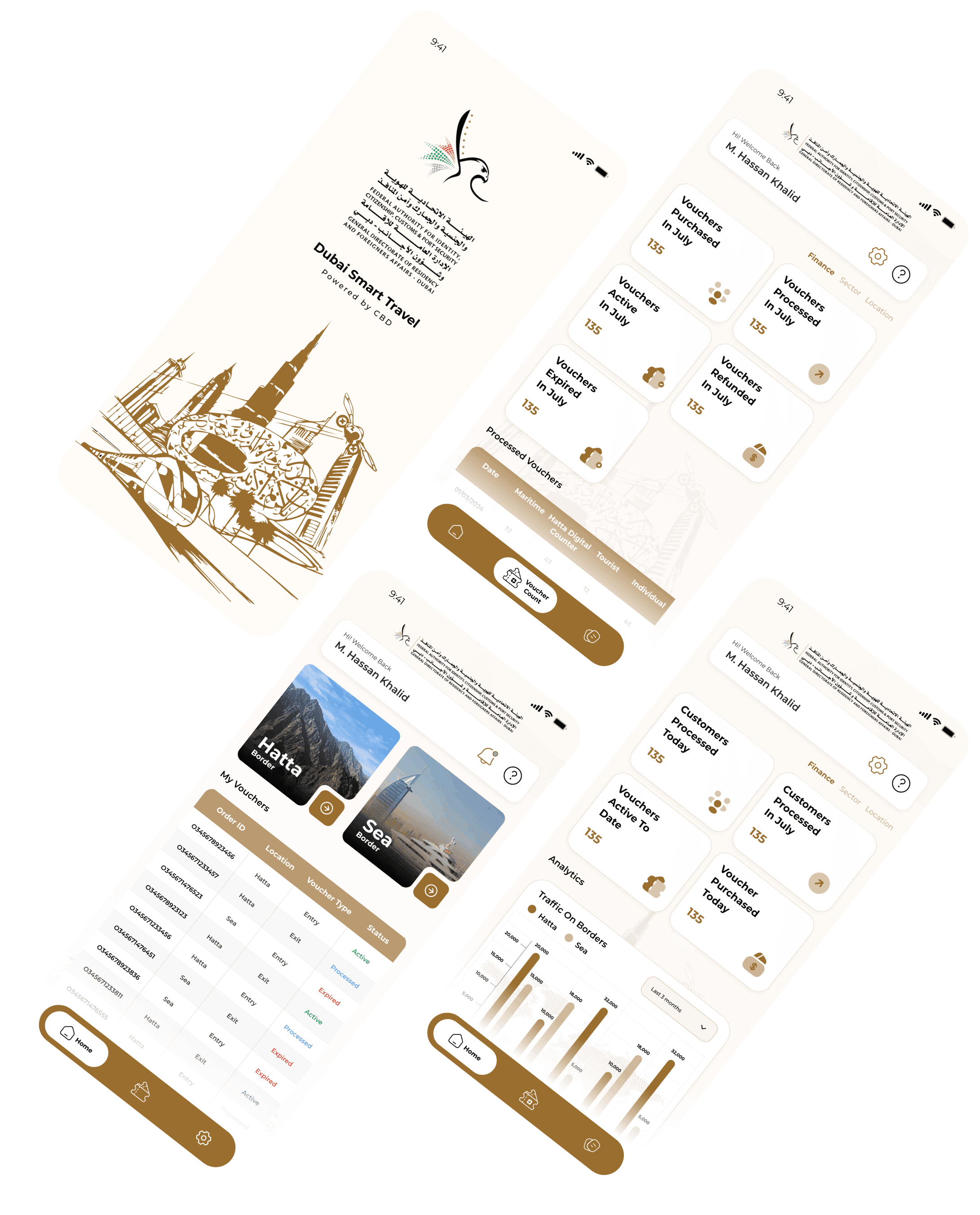

Digitising Border Fee Payments In Partnership With A Leading Bank

Industry

Financial Services

Public Sector

Monthly Transactions

Monthly Transactions

Capabilities

Intelligent Payments

Process Evolution

Experience Design

Companies Onboarded

Before PayNest

Border payments were slow, cash-based, and difficult to manage. The system worked — but only just. As travel volumes grew, inefficiencies became impossible to ignore. What should have been a smooth, routine process turned into frustration for everyone involved.

Travellers

Faced long queues and limited digital payment options, making border crossings slower and more stressful than they needed to be.

Immigration Authorities

Dealt with fragmented systems and little real-time visibility, slowing verification and decision-making at busy checkpoints.

Banks & Financial Partners

Handled manual reconciliations and disconnected reporting, creating delays, errors, and frustrated stakeholders.

The Process

We worked closely with our primary client, a leading bank in the region, and the local immigration authority to uncover their challenges. Our goal was to map the full journey, align requirements across teams, and design a solution that improved speed, accuracy, and transparency for everyone involved.

As our client’s technology partner, we built a platform that combined financial precision with government-level reliability. Built to operate under the government’s identity, it reflects their vision and requirements while being powered quietly by PayNest. Through continuous coordination, phased delivery, and rigorous testing, we delivered a product that completely modernised the border-payment experience.

The Solution

We developed a connected platform that simplifies every stage of the border-payment process. Built for speed, scale, and trust, it brings together secure transactions, financial accuracy, and operational visibility — all within one seamless ecosystem.

Instant Secure Transactions

Travellers can purchase entry and exit vouchers through a seamless, one-click digital payment flow. Secure processing, mobile convenience, and real-time verification eliminate queues and cash handling, turning border crossings into quick, effortless experiences.

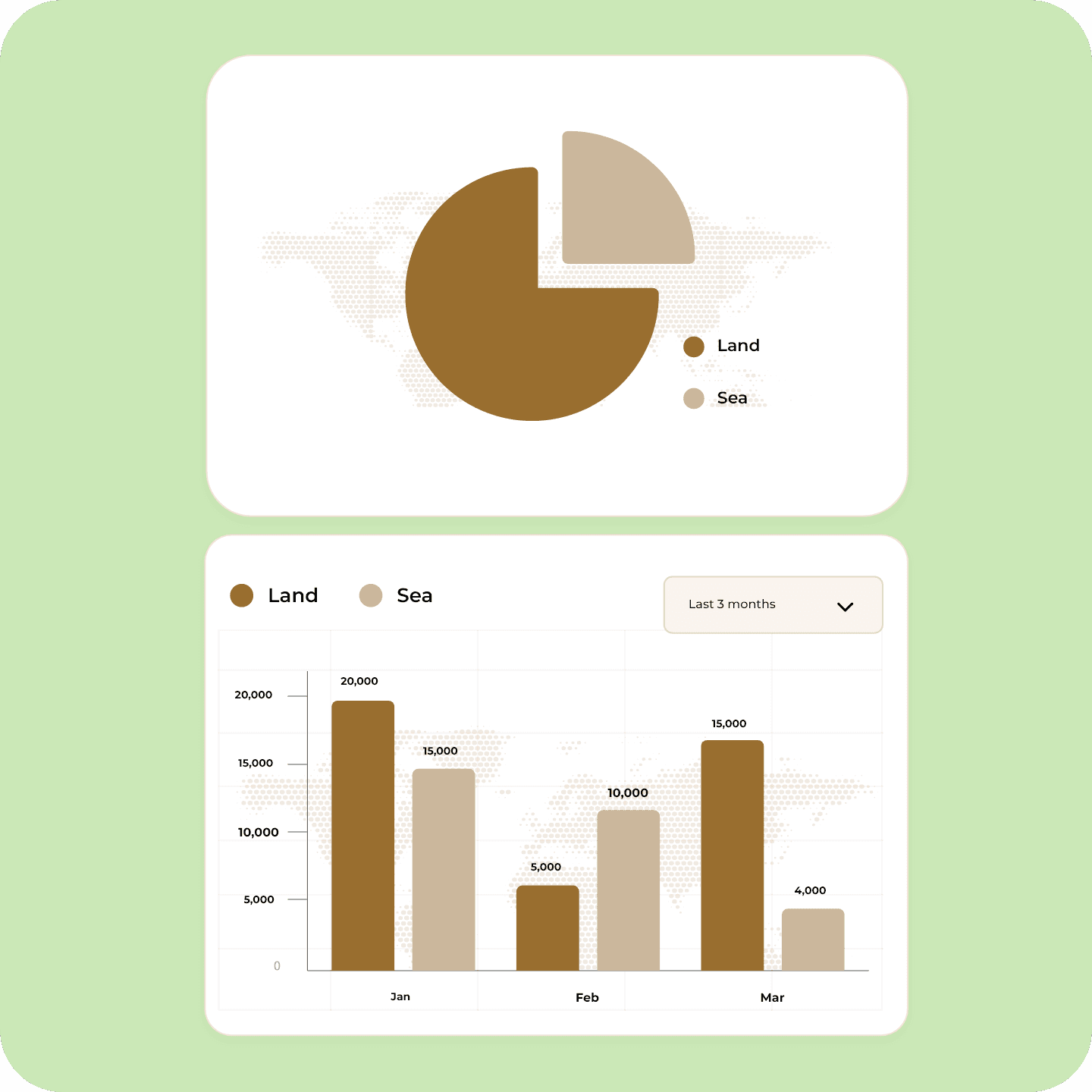

Executive Analytics Platform

A central analytics dashboard gives leadership real-time visibility into transactions, traffic patterns, and performance metrics. With data surfaced instantly, decision-makers can identify trends, monitor efficiency, and optimise operations based on clear, actionable insights.

Automated Financial Reconciliation

An intelligent reconciliation engine matches and verifies every transaction automatically. Both the bank and immigration authority gain accurate, end-of-day summaries and real-time tracking, ensuring complete transparency and compliance across the financial ecosystem.

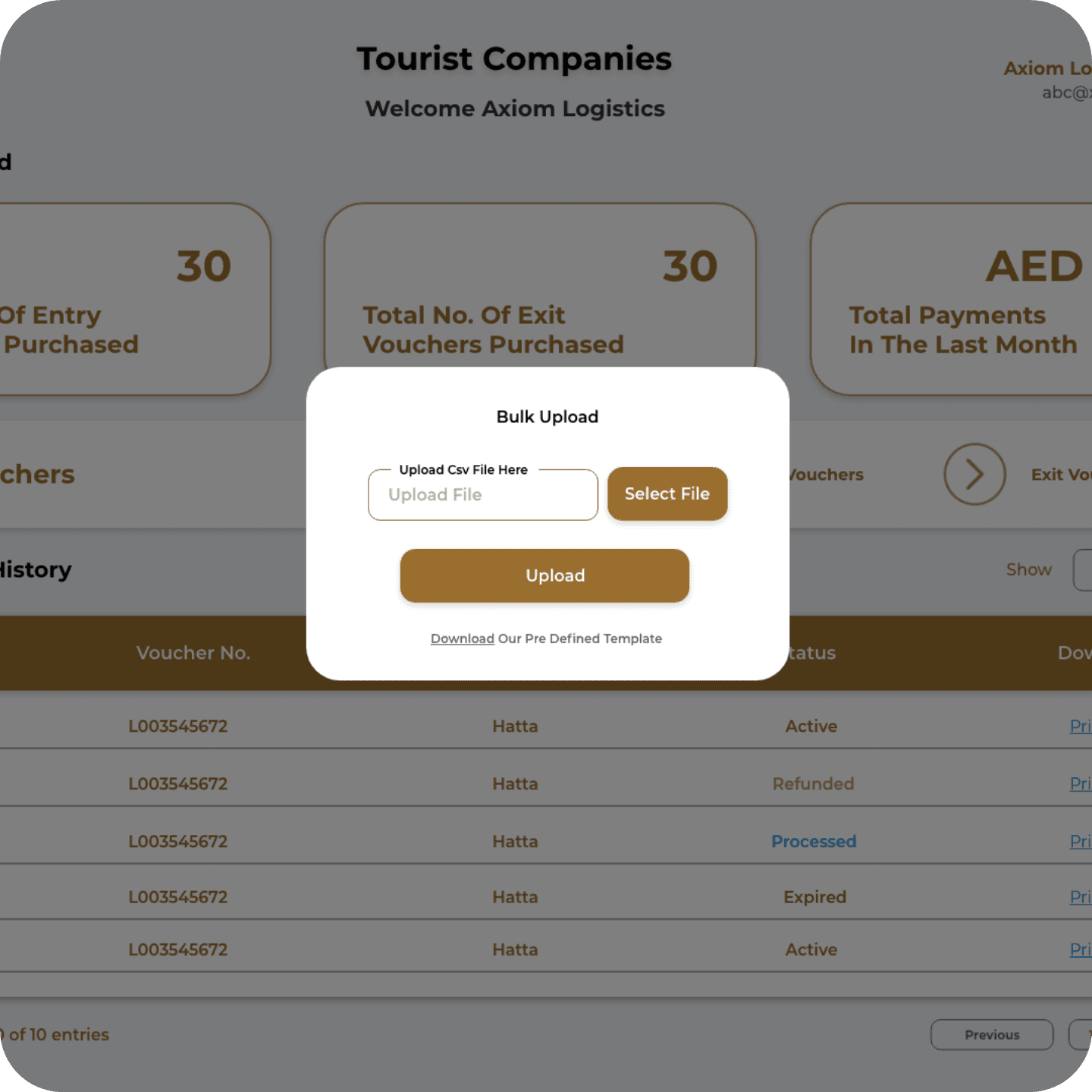

Corporate Bulk Purchasing

A dedicated B2B module allows authorised companies to manage and purchase border vouchers in bulk. Automated workflows reduce administrative time, enabling faster clearances and a more efficient experience for partners and travellers alike.

Scale and Security

The entire platform is designed for government-grade reliability. With modular architecture, audit trails, and compliance built in, it supports thousands of concurrent users while remaining adaptable for future integrations — from biometric verification to cross-border expansion.

After PayNest

Border crossings are now faster, smarter, and fully digital. What was once a manual, time-consuming process has evolved into a seamless, secure, and transparent experience for everyone involved.

Travellers

Purchase entry or exit vouchers before arrival, skip cash payments, and move through immigration in seconds.

Immigration Authorities

Gain real-time visibility into transactions and traveller data, enabling instant verification and greater control over operations.

Banks & Financial Partners

Manage reconciliations and reporting automatically through a unified platform, improving accuracy, compliance, and operational efficiency.

Discover More

Dive into more transformations, breakthroughs, and behind-the-scenes wins from our clients.

Border Payments System

Digitising exit fee payments across borders for seamless travel and real-time reconciliation.

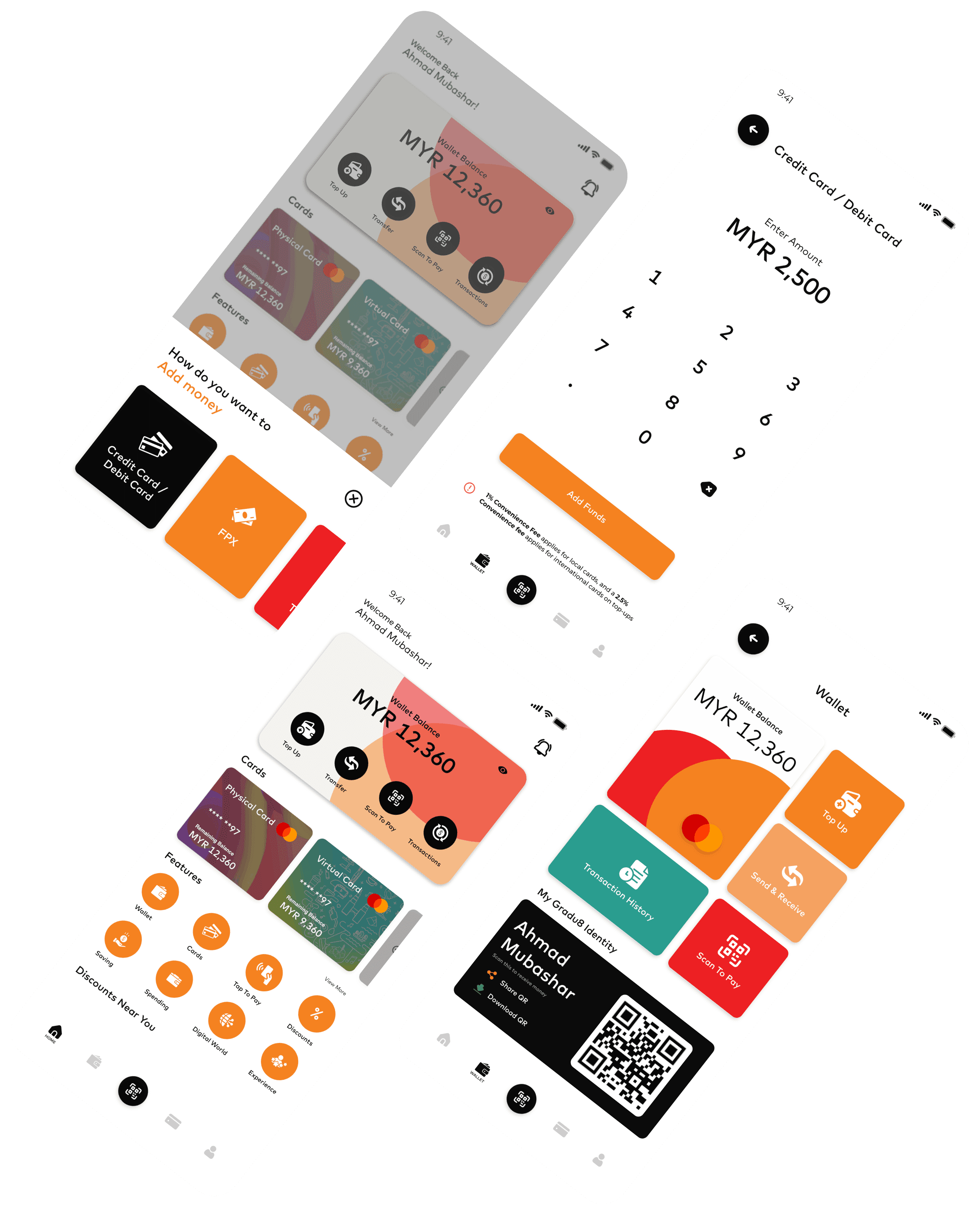

Student Lifestyle Platform

A superapp uniting payments, discounts and services to shape the future of campus life.

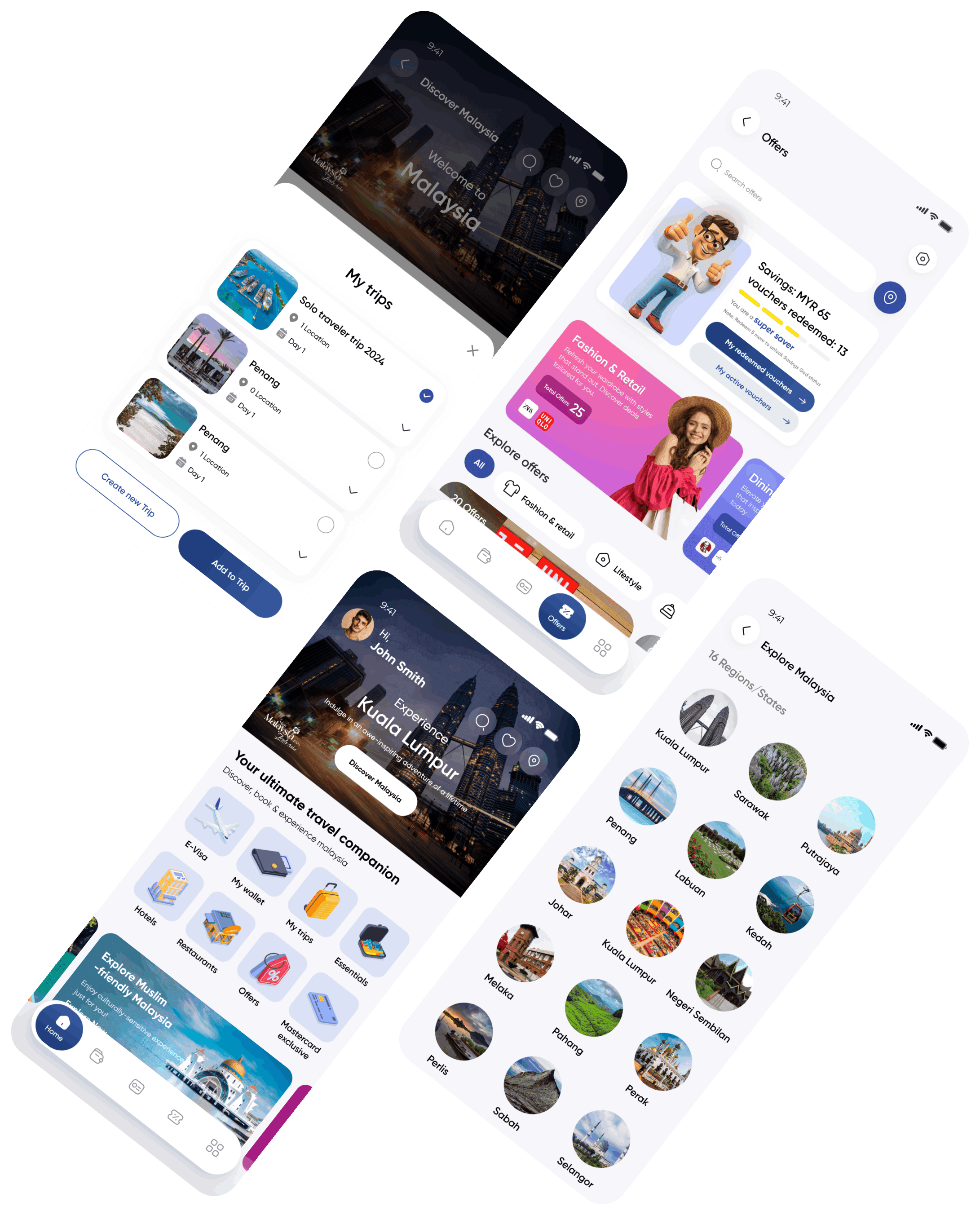

Tourism Superapp

A government-led platform seamlessly connecting travel, payments and experiences.

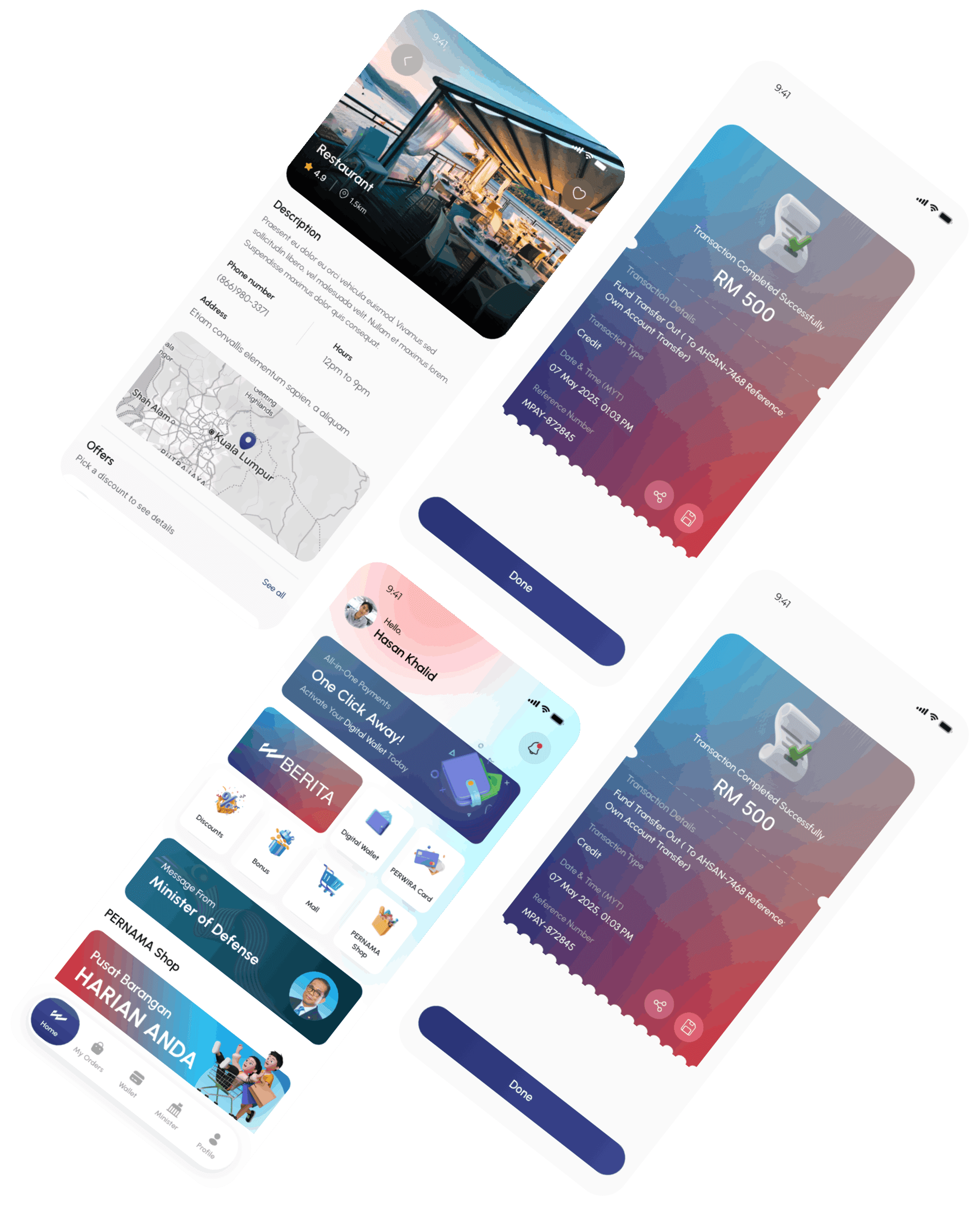

Military Community SuperApp

Powering a secure digital hub for military personnel and their families to facilitate the community